Silver Soars Above all Commodities

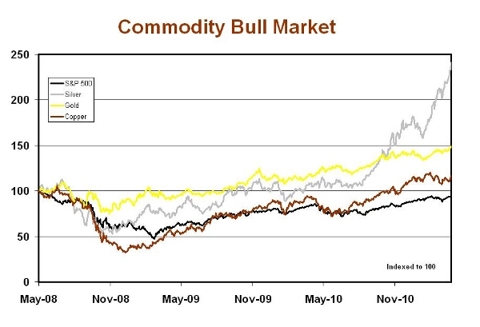

Take a look at the accompanying chart. It’s a snapshot of how four sectors – stocks, silver, gold, and copper - have fared since the market’s high in 2008. The three commodities stand out with an average gain of over 50%. The stock index (used the S&P 500, but could just as easily have used another benchmark) hasn’t gained at all. While stocks swung wildly, depending on a myriad of different factors – product-line positioning, debt structures, diverse regulatory requirements, etc. – commodities chugged on, reliably responding to the inherent needs of the marketplace.

And among commodities, there is no question of who the star was. It was silver. Indeed silver has more than doubled from its 2008 multi-year high. The rise in most commodities can be traced to the demand for them among the industries of the developing world – particularly China and India. And among those industries, silver is virtually irreplaceable. Silver is the best thermal conductor and the best electrical conductor, making it a favorite for electrical junctions. When polished, it is also one of the most reflective substances we have – making it a prime component in optics. It is a catalyst for a several fundamental reactions in industrial chemistry, including the manufacture of ethylene glycol, a vital precursor to polyester. Silver is also prevalent in automobiles, and it is used in some of the industry’s key safety applications. By virtue of its exceptional conductivity, silver is also critical to many energy efficiencies in alternative energy and other sectors. Finally, and most significantly, it is a key component in two widely separated power applications – solar panels, and pressurized-water nuclear reactors (where its ability to absorb free neutrons is crucial for control rods).

In the wake of the turmoil in the Middle East and Japan it is easy to see why demand for silver – as linked as it is to power generation and energy conservation applications - would increase. But there is something else. Silver is also a monetary metal. Indeed silver’s history as coinage is even longer than gold’s.

For more than a century, gold has been favored by institutions as a monetary metal – probably because it is much easier to store large amounts of money in gold, which is more valuable per ounce than silver, and because gold is even less susceptible than silver to tarnish and oxidation. Still, if you look at the amounts of silver available compared to amount of gold the ratio of gold to silver does not make sense. Above ground there is roughly five times more silver than gold, and below ground (according to US Government statistics) the ratio is about 10:1. So valued in terms of their relative scarcity, a silver:gold ratio of roughly 10:1 makes sense; but the current ratio of 36:1 doesn’t. The public appears to have caught on to this fact, though. Individual demand for silver coins has been soaring – which is one reason for the strong performance of the metal.

Add up all these silver factors – its industrial value, its underpricing relative to gold scarcity, and its appeal as a proxy precious metal investment for gold – and the dynamics are in place for the continuation of an explosive bull market in silver. Industrial users could even end up competing with individuals seeking protection against currency inflation. The situation could become a “virtuous circle” for pricing, one in which demand from one sector reinforces demand from the other.

The trend for gold and silver should continue higher, as dollar weakness and continued geopolitical uncertainty will support the precious metals. Gold’s next target will be $2000 an ounce which could come as early as this year and market watchers see little standing in its way. Silver could target $50 an ounce, but given the velocity of the rise, it might be due for a small correction.

I don’t know what that “danger price” would be – my guess is well into triple digits($ terms). For now my advice is to accumulate any precious metal ,whether silver or gold.

-Umesh Shanmugam(Purely my view)

No comments:

Post a Comment